Who We Are

Building financial confidence through practical education and real-world budgeting skills that make a difference in everyday life.

Practical Learning First

We don't believe in theory without application. Every concept we teach comes with hands-on exercises that you can implement immediately in your daily financial routine.

Our students practice with actual budget scenarios from Vietnamese households, working through monthly planning with realistic income figures and local expense patterns.

Cultural Context Matters

Financial planning isn't one-size-fits-all. We understand Vietnamese family dynamics, cultural expectations around money, and local economic patterns that influence budgeting decisions.

From planning for Tet celebrations to managing extended family financial responsibilities, we address the unique challenges Vietnamese families face in their budgeting journey.

Long-term Relationship Building

Education doesn't end when a course finishes. We maintain ongoing relationships with our learning community, providing continued support as financial situations evolve.

Alumni from our 2024 programs still participate in monthly check-ins and have access to updated materials as Vietnam's economic landscape changes.

Our Teaching Philosophy

Financial education shouldn't feel intimidating or overwhelming. We've spent years developing an approach that breaks down complex budgeting concepts into manageable, actionable steps.

Everyone's financial situation is different, which is why we focus on flexible frameworks rather than rigid rules. Our goal is to give you the tools and confidence to make informed decisions about your money.

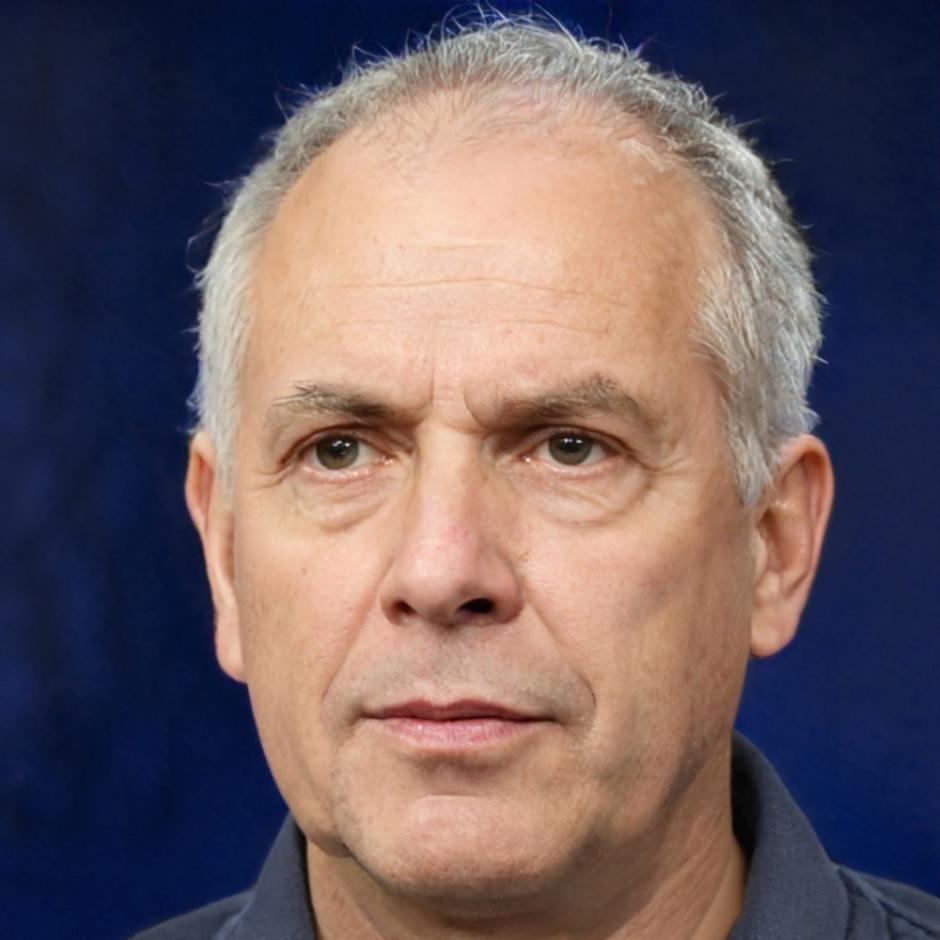

Rocco Brennan

Lead Financial Educator

Demetrius Kane

Budget Planning Specialist

Our Commitment to Students

We believe financial education should be accessible, relevant, and immediately useful. Here's what we promise to everyone who learns with us.

Clear Communication

No confusing jargon or unnecessarily complex explanations. We present financial concepts in straightforward language that makes sense to everyone.

Realistic Expectations

We're honest about what budgeting can and can't do. Financial planning is about building sustainable habits, not quick fixes or miraculous transformations.

Ongoing Support

Learning doesn't stop when formal education ends. We provide continued guidance and updated resources as your financial needs change over time.

Individual Attention

While we teach in groups, we understand that everyone's financial situation is unique. We make time for personalized guidance when needed.